Offtake arrangements announced for 100% of Platreef’s first phase production

Platreef scheduled to commence production in 2024

Definitive feasibility study for Platreef’s phased development plan expected to be issued in Q1 2022

Emissions-free, battery-electric equipment purchased for underground mine development

Platreef signs three-year collective agreement with workforce

MOKOPANE, SOUTH AFRICA – Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) Executive Co-Chair Robert Friedland and President Marna Cloete are pleased to announce that the company’s South African subsidiary, Ivanplats, has concluded stream-financing agreements with Orion Mine Finance and Nomad Royalty Company for a US$200 million gold-streaming facility and a US$100 million palladium- and platinum-streaming facility for its world-scale Platreef palladium-rhodium-platinum-nickel-copper-gold project in Limpopo Province, South Africa.

The proceeds will be used to advance the first phase of Platreef’s mine development, with commercial production expected in 2024. The definitive feasibility study for Platreef’s phased development plan, which will provide updated production forecasts for the initial mine and subsequent expansion, is nearing completion with release expected in Q1 2022.

Ivanplats also has signed documents relating to offtake arrangements for 100% of Platreef’s Phase 1 platinum-group-metals (PGMs) concentrate production, which is expected to be more than 40,000 tonnes per year containing six payable metals, including palladium, rhodium, platinum, nickel, copper and gold.

The offtake arrangements are with Northam Platinum Limited and Heron Metals Pty Ltd., a joint venture in which Trafigura Pte. Ltd. (“Trafigura”), a Singaporean registered company, has a majority shareholding. Northam Platinum is an independent, fully empowered, integrated PGM producer, with primary operations in South Africa including the wholly owned Zondereinde Mine and metallurgical complex, and Booysendal Mine. The Trafigura Group is one of the world’s leading independent commodity trading and logistics houses.

The terms of the proposed offtake with Heron Metals / Trafigura are based on a non-binding indicative term sheet and are subject to negotiation and execution of definitive documentation for a concentrate sales agreement.

“The stream financing agreements, which represent a small fraction of Platreef’s incredible resource base, and accompanying offtake arrangements are critical milestones in the progression to commercial production for Ivanplats. They provide funding for a significant portion of the mine’s initial phase of development, as well as a long-term home for our PGM, nickel and copper concentrates,” said Marna Cloete, Ivanhoe Mines’ President.

“Advancing Platreef to production also marks another step in Ivanhoe Mines’ journey to become the world’s next major, diversified mining company; one with top ESG credentials and an industry-leading portfolio of tier-one assets.

“The Platreef Mine is very scalable, and we see the first-phase, 700,000-tonne-per-annum operation as only our starter mine – one that will establish a strategic production foothold on South Africa’s Bushveld PGM Complex, and support potential future expansions of this unique orebody, which contains 59 million ounces of platinum, palladium and rhodium plus gold (3PE+Au) in indicated resources and a further 94 million ounces in inferred, in addition to significant quantities of nickel and copper, at a cut-off grade of 1 gram per tonne 3PE+Au.

“Future expansions to 12 million tonnes per annum and beyond, as demonstrated in previous studies, would position Platreef among the world’s largest and lowest-cost nickel and PGM mines, producing more than 24,000 tonnes of nickel and 1.1 million ounces of palladium, rhodium, platinum, and gold per year; and help feed the demand for critical electric minerals that the world needs as it transitions to a net-zero future.

“The phased development approach has worked extremely well at Kamoa-Kakula and we consider it to be the optimal strategy to accelerate our growth and diversification across commodities, and maintain a healthy balance sheet. The mineral endowment at Platreef is enormous and we fully intend to continue expanding the mine with the construction of Shaft 2, with the team working hard on opportunities to accelerate its availability for hoisting. We are passionately focused on being part of the solution as the world transitions to clean, renewable energy.

“We also are very pleased to conclude a three-year collective agreement with our employees that values and respects their expertise, their contributions during the pandemic, and their role in building the world’s next great mine.”

Watch a new video showcasing Platreef:https://vimeo.com/653933836/681b732b3e

Electrician, Mefika Khumalo (left); and Fitter, Agnes Maupye, about to commence with shaft equipping activities.

Fitter Rudolf van Wyk inspecting the Shaft 1 headframe.

Ivanplats secures US$200 million gold stream financing and US$100 million palladium and platinum stream financing

Ivanplats has entered into a gold, palladium and platinum stream financing with Orion Mine Finance, a leading international provider of customized financing to mining companies, and Nomad Royalty Company, a precious metals royalty company, in which Orion Mine Finance is a significant shareholder (Orion Mine Finance and Nomad Royalty Company, together, the “Stream Purchasers”). This transaction will fund a large portion of the Phase 1 capital costs, with initial production scheduled in 2024.

Under the stream agreements, Orion Mine Finance will provide a total of US$225 million in funding, and Nomad Royalty Company will provide US$75 million in funding. The stream facilities are a prepaid forward sale of refined metals, with prepayments totaling US$300 million, available in two tranches with the first prepayment of US$75 million to be paid following the closing of the transaction and US$225 million to be paid upon satisfaction of certain conditions precedent.

Under the terms of the US$200 million gold stream agreement, the Stream Purchasers will receive an aggregate total of 80% of contained gold in concentrate until 350,000 ounces have been delivered, after which the stream will be reduced to 64% of contained gold in concentrate for the remaining life of the facility. The expected life of this facility will extend from the effective date of the stream agreement until the date when 685,280 ounces of gold have been delivered to the Stream Purchasers. The Stream Purchasers will purchase each ounce of gold at a price equal to the lower of the market price of gold or US$100 per ounce.

Under the terms of the US$100 million palladium and platinum stream agreement, Orion Mine Finance will receive an aggregate total of 4.2% of contained palladium and platinum in concentrate until 350,000 ounces have been delivered, after which the stream will be reduced to 2.4% for the remaining life of the facility. The expected life of this facility will extend from the effective date of the stream agreement until the date when 485,115 ounces of palladium and platinum have been delivered to the purchaser, which will pay for each ounce at a price equal to 30% of the market price of palladium and platinum.

The conclusion of the stream agreements allows Ivanplats to focus efforts on finalizing the senior debt facility for up to US$120 million. Societe Generale and Nedbank were appointed as mandated lead arrangers for the project debt facility in early 2021. Both the gold stream facility, and palladium and platinum stream facility, will be subordinated to any senior secured financing.

The senior debt facility is anticipated to be used only after the stream facilities are fully drawn. Ivanplats remains flexible to raise additional debt or equity at a later date, and has pre-agreed with the Stream Purchasers the intercreditor arrangements for any future senior debt. While the stream facilities are guaranteed by Ivanplats and secured over the assets and Ivanhoe’s shares of Platreef, there is no recourse to Ivanhoe Mines.

Members of the Orion and Nomad teams with members of Platreef’s mine development team at the foundation for the Shaft 2 headframe that is under construction.

Ivanplats arranges offtake for Platreef’s Phase 1 production

Ivanplats has signed documents relating to offtake for 100% of Phase 1’s PGM concentrate production of at least 40,000 tonnes per year, based on standard commercial terms for PGM mines in South Africa. This reinforces the high quality of Platreef’s PGM concentrate, which contains six payable metals including palladium, rhodium, platinum, nickel, copper and gold.

Ivanplats has finalized a PGM concentrate sales agreement with Northam Platinum for 50% of concentrate production from Phase 1 at Platreef, which totals approximately 20,000 tonnes per year. The agreement is in place for a period of ten years, and Ivanplats retains the option to reduce the volume by 5,000 tonnes to an annual total of 15,000 tonnes.

Ivanplats also has signed a non-binding indicative term sheet with Heron Metals, a Trafigura joint venture, relating to the sale and purchase of 50% of the PGM concentrate production from Phase 1 at Platreef, which equals approximately 20,000 tonnes per year, and would also be in place for a period of ten years. Under the proposed terms, Ivanplats retains the option to reduce the volume by 5,000 tonnes to an annual total of 15,000 tonnes. Ivanplats may also elect to receive a provisional payment of 90%, five days after the month of delivery. The final terms of the offtake with Heron Metals remain subject to negotiation and execution of definitive documentation.

Shaft 1 changeover to a production shaft advancing rapidly

As part of the phased development plan, Platreef’s 996-metre-deep Shaft 1 will be used to initially access the high-grade Flatreef orebody that has an average thickness of 26 metres – massive when compared to the typical, approximately one-metre-thick reefs being mined elsewhere on South Africa’s Bushveld Complex. The remarkably thick Flatreef orebody also is flat-lying, which is ideal for safe, bulk-scale, mechanized mining and processes optimized for maximum ore extraction.

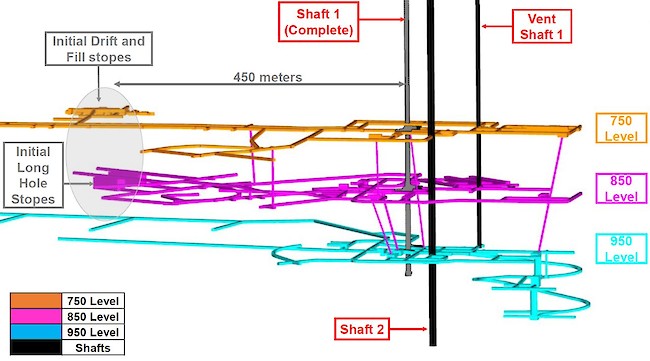

Shaft 1 has three development stations that will provide underground access to Flatreef, on the 750-, 850-, and 950-metre levels. The current focus is on equipping the 950-metre level station with rock-handling and mining infrastructure. The 950-metre level is the lowest mining level, where skip loading will take place – initial lateral development will start from this station.

Shaft 1 will be used to initially access the high-grade Flatreef orebody, with lateral development to commence from the 950-metre-level station.

Changeover construction of the 996-metre-deep Shaft 1 is progressing to plan and is on schedule for commencement of rock hoisting early in 2022.

The 850-metre-level station with all shaft steelwork in place. Following the establishment of a rock-pass system from the 750-metre level to the 950-metre level, development will commence towards the high-grade Flatreef orebody on the 850-metre level.

After the 950-metre level is completed, the higher stations will be provided with rock-tipping and ore-pass infrastructure, with the equipping expected to be completed in early 2022.

The changeover construction at Shaft 1 is progressing to plan and on schedule for commencement of rock hoisting, also early in 2022. All materials, consumables and equipment for the shaft changeover have been procured and all designs completed. The changeover work is being done by Platreef’s experienced owners’ team with a focus on safety, and a full quality assurance and control system is in place.

The winder that was used to sink and equip Shaft 1 will be the permanent rock, personnel and material winder following the shaft-equipping phase. The shaft will be equipped with two 12.5-tonne skips with a fixed man and material cage installed above the skips in both compartments, an optimization that will allow for an increase in hoisting capacity which will be discussed in the forthcoming definitive feasibility study.

Lateral mine development on the 950-metre level toward the Flatreef ore body is expected to begin in Q2 2022. The initial development will use battery-electric M2C drill rigs and 14-tonne load haul dumpers being manufactured by Epiroc, a leading mining equipment manufacturer, at its facilities in Örebro, Sweden. The partnership with Epiroc for emissions-free mining equipment is an important first step towards reducing the carbon footprint of the mine, with learnings to be employed across Ivanhoe Mines’ operations.

The battery-electric mining fleet is expected to arrive on site in early 2022. Ivanplats plans to install solar photovoltaic cells to recharge the electric fleet’s batteries.

The contract for the initial mine development has been adjudicated and is in the final stages of negotiation. Newly designed rock chutes on surface will connect the conveyors feeding the concentrator plant and the waste rock area; from there the waste rock will be crushed and used as cemented backfill underground for maximum ore extraction, as well as for protection berms to contain storm water and reduce noise emissions.

The waste-rock conveyor from Shaft 1 is progressing to plan with all mechanical and electrical orders well advanced. Delivery of the stacker is planned for February 2022 and the complete waste conveyor load-out system is expected to be fully operational shortly thereafter.

Pilot drilling of the first main ventilation shaft will commence in 2022, after which it will be reamed to its final diameter of 5.1-metres, providing the main return airway for the Phase 1 development. On completion, this ventilation shaft also will serve as a second egress from the mine.

Crew constructing the new waste-rock conveyor system at Platreef’s Shaft 1 headframe. A second conveyor system also will be installed to feed the concentrator plant with high-grade ore from underground mining.

Manufacturing and assembly of a battery-electric, mechanized drill rig at the Epiroc facilities in Örebro, Sweden (a Boomer M2C drill rig) that will be used for underground development. Delivery is expected early in 2022.

Members of Platreef’s mine development crew preparing to go underground. Their work currently is focused on completing the equipping of Shaft 1 as Platreef’s initial production shaft.

Shaft 2 headframe construction well underway, with plans to accelerate completion

Early surface construction for Shaft 2 began in 2017, including the excavation of a surface box-cut to a depth of approximately 29 metres below surface, and construction of the concrete hitch for the 103-metre-tall concrete headframe (headgear), which will house the shaft’s permanent hoisting facilities and support the shaft collar. The Shaft 2 headframe construction, from the hitch to the collar level, is progressing well with completion expected in May 2022.

With the possibility of increased hoisting capacity at Shaft 1, the mining and engineering teams, in conjunction with leading consultants, is evaluating changes to the sinking methodology for Shaft 2 to significantly accelerate the availability of the shaft for hoisting, compared to the previously released preliminary economic assessment.

Aerial view of current progress at Platreef, with the Shaft 2 headframe construction site on the right, and the headframe for Shaft 1 on the left.

Platreef’s 103-metre-high main Shaft 2 superimposed on the right, will be constructed from the hitch to the collar (at surface). The headframe for Shaft 1 is on the left.

Ivanplats launches inaugural cadetship program for local youthIvanplats launches inaugural cadetship program for local youth

Ivanplats recently launched its first cadetship program, providing opportunities to 50 local youth every year. The program seeks to enhance gender diversity, with 54% of the learners being female; and offers a national certificate in health and safety, as well as mining competencies, such as utility vehicle operations.

In collaboration with South Africa’s Murray & Roberts Training Academy, Ivanplats established a training facility in Mokopane, which will include e-learning, equipment simulators, and professional coaching. Cadets will be instructed in underground mining and engineering, and prepared for skilled jobs like those that will be needed at Platreef.

“We are committed to mining in a responsible way, where sustainable benefits are actively shared with our neighbours and local communities,” explained Dr. Patricia Makhesha, Ivanhoe Mines’ Executive Vice President, Sustainability and Special Projects. “Skill development and education efforts like the cadetship program nurture talented, local workforces; and prepare many bright, young women and men for skilled opportunities in South Africa’s mining industry, which is set to play a very important role in supplying minerals critical for the world-wide transition to clean energy.

“Ivanplats is excited about the community-training facility in Mokopane, and welcoming our inaugural cadet class. Platreef will be proudly developed under strong partnerships and alongside local communities. Our culture is the heartbeat of the organization and is rooted in a deep commitment to the sustainable development path.

Ivanplats Senior Human Capital Manager, Jacques Malan, welcoming the new cadets from Mokopane local communities.

Construction of the concrete foundation for Platreef’s Shaft 2 headframe. Shaft 2 will have a finished and concrete-lined internal diameter of 10 metres, and be sunk to a final depth of 1,104 metres below surface.

Equipment Operator Evelyn Mafafo, a member of Platreef’s mine development team. Ivanhoe has prioritized an increase in the number of female employees at all of its mine development projects.

Ivanplats’ COVID-19 readiness initiatives prioritize vaccination campaign and risk mitigation

The medical, safety and management teams at Ivanplats actively monitor the COVID-19 pandemic. Protocols are continuously reviewed and optimized based on available data and public health guidelines; as a result, Ivanplats has implemented several measures to prevent and mitigate the escalation of infections and the impact on operations.

Those measures include the mass testing of all employees, contractors and visitors, provision of transport to employees and a vaccination rollout. By the end of November 2021, a total of 5,212 COVID-19 tests had been conducted.

In support of the National Department of Health’s national vaccine rollout strategy, Ivanplats launched an on-site COVID-19 vaccination campaign. Approximately 86% of the Platreef Project’s employees and contractors working on site have at minimum received their first vaccine dose.

Rigorous testing, physical distancing, wearing face masks, frequent hand washing, and contact-tracing measures remain in place to protect the safety and health of the workforce and community members. The project’s preventative measures are at the highest international standards. Following a COVID-19 risk assessment review, Ivanplats is currently developing a mandatory vaccination policy, which it intends to implement in early 2022.

As previously reported, there have been some recent Omicron-variant infections among employees and contractors working at the Platreef Project; all people infected to date have either been asymptomatic or experienced very mild symptoms. The rate of infection observed across the workforce has been over four times higher in unvaccinated individuals.

The department of health has approved a COVID-19 quarantine facility in the local village of Masodi for Platreef employees and contractors who cannot safely isolate at home. The current occupancy is zero.

Nurse Edith Manamela (left) administering a COVID-19 test on Surveyor Akila Mokwena prior to commencing his shift.

Shaft Sinking and Construction Manager Apie Pretorius was among the 86% employees and contractors who have received their COVID-19 vaccinations.

In anticipation of the fourth wave of Covid-19 infections, Platreef has introduced an electronic facial-recognition and fever-screening system at all access points to ensure effective screening and control.

Lawrence Monama sanitizing the shared spaces at the Shaft 1 bank area.

Kamoa-Kakula monthly update to be issued within the week

Ivanhoe Mines also announces that the November progress update for the Kamoa-Kakula Copper Mine in the Democratic Republic of Congo is expected to be issued within the next week.

About the Platreef Project

The Platreef Project is owned by Ivanplats (Pty) Ltd (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. Ivanplats reached Level 4 contributor status in its most recent verification assessment on the B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation, and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is primarily hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly-mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties that form part of the company’s mining right.

Qualified Persons and NI 43-101 Technical Report

In December 2020, Ivanhoe Mines filed a new National Instrument 43-101 (NI 43-101) technical report titled “Platreef Integrated Development Plan 2020” with an effective date of December 6, 2020 (Platreef IDP20).

The Platreef IDP20, which includes the Platreef 2020 FS and Platreef 2020 PEA, was independently prepared by OreWin Pty Ltd. of Adelaide, Australia; Wood plc (formerly Amec Foster Wheeler) of Vancouver, Canada; SRK Consulting Inc. of Johannesburg, South Africa; Stantec Consulting International LLC of Phoenix, USA; DRA Global of Johannesburg, South Africa; and Golder Associates Africa of Midrand, South Africa.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project.

Other scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal projects in Southern Africa: the development of major new, mechanized, underground mines at the Kamoa-Kakula copper discoveries in the Democratic Republic of Congo and at the Platreef palladium-rhodium-platinum-nickel-copper-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the Democratic Republic of Congo.

Kamoa-Kakula began producing copper concentrates in May 2021 and, through phased expansions, is positioned to become one of the world’s largest copper producers. Kamoa-Kakula is being powered by clean, renewable hydro-generated electricity and is projected to be among the world’s lowest greenhouse gas emitters per unit of metal produced. Ivanhoe Mines has pledged to achieve net-zero operational greenhouse gas emissions (Scope 1 and 2) at the Kamoa-Kakula Copper Mine. Ivanhoe also is exploring for new copper discoveries on its Western Foreland exploration licences in the Democratic Republic of Congo, near the Kamoa-Kakula Project.

Information contacts

Investors: Bill Trenaman +1.604.331.9834 / Media: Matthew Keevil +1.604.558.1034

Cautionary statement on forward-looking information

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements of the company, the Platreef Project, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results, and speak only as of the date of this news release.

The forward-looking statements and forward-looking information in this news release include without limitation, (i) statements regarding the funding and drawdown under the stream agreements, (ii) statements regarding the offtake arrangements and that the offtake arrangements with Trafigura remain subject to negotiation and execution of definitive documentation; (iii) statements regarding the establishment of the senior project debt facility, and its term and conditions, (iv) statements regarding the timing of the first draw of the streaming facility and that the senior project debt facility would only be utilized after the streaming facility is fully drawn; (v) statements regarding the acceleration of Shaft 2 development or commissioning; (vi) statements that Platreef is scheduled for production in 2024; (vi) statements that the definitive feasibility study for phased expansion is expected early 2022; (vii) statements that changeover construction at Shaft 1 is progressing to plan and is on schedule for commencement of rock hoisting early in 2022; (viii) statements that lateral mine development on the 950-metre level toward the high-grade Flatreef ore body is expected to begin in Q2 2022; (ix) statements that the battery-electric mining fleet is expected to arrive on site in early 2022; (x) statements regarding the expected scheduling around the sinking of Shaft 2. In addition, all of the results of the Platreef IDP20, Platreef 2020 PEA and Platreef 2020 FS constitute forward-looking statements and forward-looking information.

All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, industrial accidents or machinery failure (including of shaft sinking equipment), or delays in the development of infrastructure, and the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Readers are cautioned not to place undue reliance on forward-looking information or statements. Certain of the factors and assumptions used to develop the forward-looking information and statements, and certain of the risks that could cause the actual results to differ materially are presented in the “Platreef Integrated Development Plan 2020”, available on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources and Mineral Reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on, among other things: (i) fluctuations in platinum, palladium, gold, rhodium, copper, nickel or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) changes to proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

English

English Français

Français 日本語

日本語 中文

中文