FS evaluates a 4.4-million-tonne-per-annum (Mtpa) underground mine with annual production of more than 500,000 ounces of palladium, platinum, rhodium and gold; plus more than 35 million pounds of nickel and copper, becoming a world-scale producer of critical “green metals”

Weighted price of the ‘basket’ of the four precious metals contained in Platreef’s ore more than $2,100 an ounce

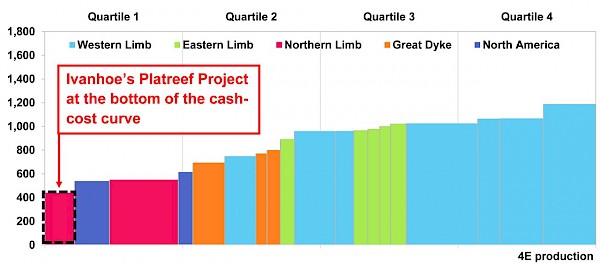

FS yields an after-tax NPV8% of US$1.8 billion and IRR of 20% at long-term consensus metal prices, and an after-tax NPV8% of US$3.7 billion and IRR of 28% at spot metal prices; re-affirming Platreef’s potential to be the world’s lowest-cost primary producer of platinum-group metals, with a cash cost of US$442 per ounce of palladium, platinum, rhodium and gold, net of by-products and including sustaining capital

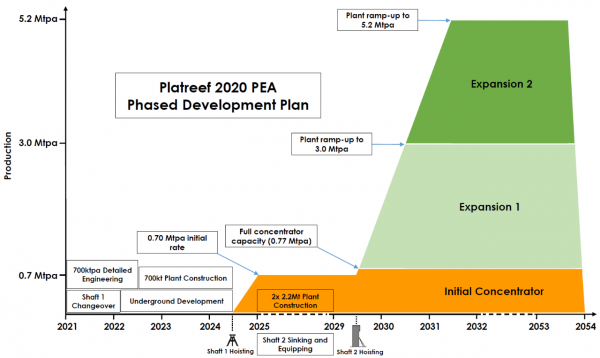

Ivanhoe also announces a preliminary economic assessment (PEA) for the phased development plan; an alternate scenario to expedite production, with much lower initial capital, using Shaft 1 for the mine’s initial five years of production, followed by an expansion to 5.2 Mtpa once Shaft 2 is completed

With an initial capital cost of US$390 million, the PEA yields after-tax NPV8% of US$1.6 billion and IRR of 20% at long-term consensus metal prices, and an after-tax NPV8% of US$3.3 billion and IRR of 29% at spot metal prices

PEA envisages a potential throughput rate of 5.2 Mtpa, with annual production of more than 600,000 ounces of palladium, platinum, rhodium and gold, plus over 40 million pounds of nickel and copper

Detailed engineering studies are underway on the initial 0.7 Mtpa mine and concentrator, in parallel with the transition of Shaft 1 to a production shaft

FS and PEA both establish an operating platform to underpin future expansions, leveraging Platreef’s immense resource base

Significant interest from a number of finance providers to fund development, with advanced discussions underway

MOKOPANE, SOUTH AFRICA – Ivanhoe Mines’ (TSX: IVN; OTCQX:IVPAF) Co-Chairs Robert Friedland and Yufeng “Miles” Sun announced today that the company’s South African subsidiary, Ivanplats, and its partners welcome the outstanding positive findings of anindependent Platreef Integrated Development Plan 2020 (Platreef IDP20) for the tier one Platreef palladium, platinum, rhodium, nickel, copper and gold project in South Africa, whichconsists of an updated feasibility study (Platreef 2020 FS) and a preliminary economic assessment (Platreef 2020 PEA).

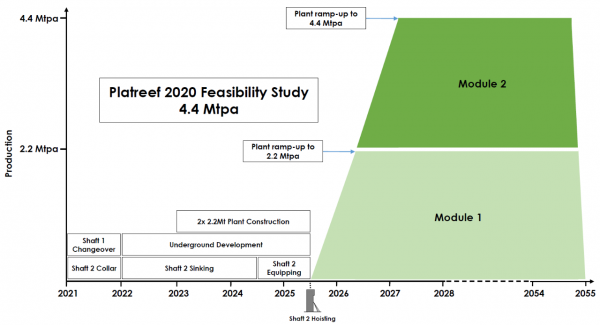

The Platreef 2020 FS builds on the excellent results of the FS announced in July 2017 and is based on an unchanged Mineral Reserve, project designs for mining, and plant and infrastructure as in the Platreef 2017 FS; except with an increased production rate from 4.0 Mtpa to 4.4 Mtpa, in two modules of 2.2 Mtpa.

The 2020 FS includes an updated production schedule based on the current project status, costs and economic assumptions. The schedule for the 2020 FS is driven by the sinking of the project’s second, larger shaft (Shaft 2), where early works have commenced. The 2020 FS envisions Shaft 2 equipped for hoisting in 2025, allowing for first concentrate production in the latter half of the year. The initial capital cost for the Platreef 2020 FS is estimated at US$1.4 billion.

The Platreef IDP20 also includes the Platreef 2020 PEA, which is an alternate, phased development plan that fast-tracks Platreef into production. The plan uses the project’s first shaft (Shaft 1) for initial hoisting and mine development, with 825,000 tonnes of annual total rock hoisting capacity, of which 125,000 tonnes is allocated for development rock. The alternate plan envisions building an initial concentrator with a capacity of 770 thousand-tonnes-per-annum (ktpa), and could produce first concentrate in mid-2024.

The recently-completed sinking of Shaft 1 has created the opportunity to access early, high-grade tonnes in this scenario. While the 700-ktpa initial mine is being operated using Shaft 1, there would be opportunities to refine the timing of subsequent phases of expanded production, which is driven by the sinking of Shaft 2. Once completed, two 2.2 Mtpa concentrator modules would be commissioned, and the initial concentrator would be ramped up to its full capacity of 770 ktpa; increasing the steady-state production to 5.2 Mtpa. The initial capital cost for 700 ktpa under the Platreef 2020 PEA is estimated at US$390 million – substantially lower than the Platreef 2020 FS that requires Shaft 2 for first production.

Detailed engineering has commenced on the mine design, 770-ktpa concentrator and associated infrastructure for the phased development plan, which will be incorporated into an updated feasibility study in 2021. The Shaft 1 changeover will take place simultaneously in preparation for permanent hoisting by early 2022. The budget for 2021 is US$59 million, which includes US$10 million for commencement of the construction of the headframe to the collar of Shaft 2.

The Platreef IDP20 reflects the first phase of development for the Platreef Mine. It is designed to establish an operating platform to support potential future expansions to 12 Mtpa and beyond, as demonstrated in previous studies, which would position Platreef among the largest platinum-group metals producing mines in the world, producing in excess of 1.1 million ounces of palladium, platinum, rhodium and gold per year.

Updated FS re-affirms the outstanding economics of Platreef at 4.4-Mtpa production rate, while the PEA demonstrates optionality to bring Platreef into production faster by using Shaft 1, with significantly lower initial capital cost

Mr. Friedland commented: “These powerful, independent economic results mark an important step in our vision of building and operating the world’s next great precious metals mine, together with our local community and Japanese partners. We’re now 25 years into discovering and developing the Platreef discovery, which has an unparalleled endowment of palladium, platinum, rhodium and gold; as well as large quantities of nickel and copper. And it still has tremendous potential to significantly expand the resource base, including a plethora of new exploration opportunities, many of which are near-surface.

“We have a mining licence, we have water, we have an orebody that is as thick as an eight-storey building, and we have a team of highly-skilled employees. We also have a ‘basket’ of precious metals contained in the ore at Platreef that have risen in recent years to levels in excess of US$2,100 an ounce for platinum-group metals and gold.

“The thick and flat-lying nature of the high-grade mineralization of Platreef’s Flatreef deposit will accommodate the use of mechanized and state-of-the-art, automated mining techniques; allowing us to efficiently and safely bring material to surface to produce precious metals vital to a proliferation of modern technologies.

“PGMs have a very bright future in clean energy, including hydrogen fuel cells, while nickel and copper are clearly vital metals for global decarbonization initiatives and worldwide electrification. We’re living in an era of unprecedented change, with the world breeding mega-cities prodigiously. One result is increasingly toxic air, with a whole suite of health effects from heart attacks to stroke, asthma and dementia. If you want clean air, and if you want to stop burning coal and hydrocarbons, the world immediately needs vastly more copper, nickel, and platinum-group metals.”

Palladium and rhodium have been two of the best performing metals in recent years, currently trading at approximately US$2,400 an ounce and $16,100 an ounce respectively, as stricter air-quality rules boost demand for the metals used in vehicle pollution-control devices. Platreef has an estimated 18.9 million ounces of palladium in current Indicated Mineral Resources, and an additional 23.8 million ounces in current Inferred Mineral Resources, at a 2.0 g/t 3PE+Au cut-off. Platreef has an estimated 1.2 million ounces of rhodium in current Indicated Mineral Resources, and an additional 1.6 million ounces in current Inferred Mineral Resources, at a 2.0 g/t 3PE+Au cut-off.

“The feasibility study demonstrates once again the incredible efficiency that can be achieved at Platreef when Shaft 2, one of the largest shafts in Africa, is completed. It confirms without a shadow of a doubt, that not only is Platreef one of the largest, richest precious metals deposits on the planet, but it also will be one of the lowest-cost operations and feature exceptional returns on capital,” Mr. Friedland added.

“Now that Shaft 1 is complete, the phased development plan shows that there is an exciting alternate path to develop this great deposit, with much lower upfront capital requirements, to establish a strategic production foothold on the emerging Northern Limb of South Africa’s prolific Bushveld Complex. In turn, this can be leveraged to unlock Platreef’s tier one, long-life mineral potential.”

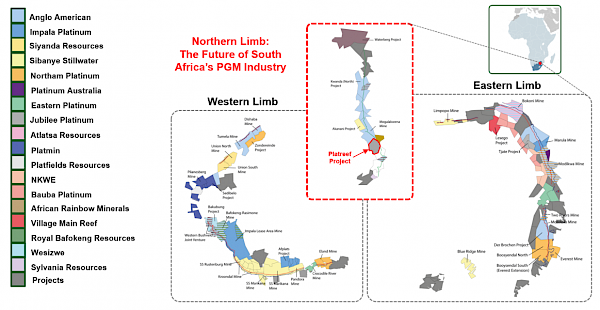

Marna Cloete, Ivanhoe’s President and CFO, commented: “The Northern Limb is the future of South Africa’s platinum-group-metals mining industry. Platreef will have the distinct advantage of having a highly mechanized, underground mining operation with a small environmental footprint. Approximately 60% of the mine’s tailings will be sent back underground to fill mined-out voids, and the remainder will be treated using sustainable, dry-stack technology, conferring additional significant environmental, safety and economic advantages. On behalf of our stakeholders, international shareholders and progressive end users of our metals, we are pleased to be leading the positive transformation in the way future underground platinum-group-metals mining operations in South Africa will be conducted.”

Dr. Patricia Makhesha, Ivanhoe’s Executive Vice President, Sustainability and Special Projects, stated: “We are very proud to share 25 years of exploration and development achievements at Platreef with our local communities and stakeholders. These stakeholders, including more than 150,000 local Mokopane area residents, see international investment and responsible development of natural resources as key to unlocking critical opportunities for widespread, long-term prosperity.”

“We believe world-scale projects like Platreef will be integral as South Africa plans its economic future around the green-energy transition and materials that will fuel a growing, global clean-technology supply chain. We’re excited to create sustainable, long-term transformative opportunities for our stakeholders, which include employment, procurement and development opportunities,” Dr. Makhesha added.

Development scenarios at Platreef

The Platreef Integrated Development Plan 2020 encompasses two development scenarios:

- Platreef 2020 FS, an update of the 2017 FS: Evaluates the development of a 4.4 Mtpa underground mine with two concentrators built in modules of 2.2 Mtpa. This updates the 2017 FS by taking into account development schedule advancement since 2017, as well as updated costs, metal prices and foreign exchange assumptions; in addition to increased throughput from 4.0 Mtpa to 4.4 Mtpa to utilize the full processing capacity of the two concentrators.

- Platreef 2020 PEA (Phased Development Plan): An alternative scenario evaluating the phased development of an initial 700-ktpa underground mine using the existing Shaft 1 and a new concentrator with a capacity of up to 770 ktpa, targeting high-grade mining areas with significantly lower capital costs. After first production is achieved, Shaft 2 sinking commences, to coincide with the construction of two additional 2.2 Mtpa concentrator modules, and the ramp up of the initial concentrator to its full capacity of 770 ktpa, increasing the steady production to 5.2 Mtpa. Shaft 2 development may be brought forward to accelerate this expansion.

Ivanhoe Mines indirectly owns 64% of the Platreef Project through its subsidiary, Ivanplats, and is directing all mine development work. The South African beneficiaries of the approved broad-based, black economic empowerment structure have a 26% stake in the Platreef Project. The remaining 10% is owned by a Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation; ITC Platinum Development Ltd., an ITOCHU affiliate; and Japan Gas Corporation.

The Platreef IDP20, which includes the Platreef 2020 FS and Platreef 2020 PEA, was independently prepared on a 100%-basis by OreWin Pty Ltd. of Adelaide, Australia; Wood plc (formerly Amec Foster Wheeler) of Vancouver, Canada; SRK Consulting Inc. of Johannesburg, South Africa; Stantec Consulting International LLC of Phoenix, USA; DRA Global of Johannesburg, South Africa; and Golder Associates Africa of Midrand, South Africa.

The Platreef 2020 PEA is preliminary in nature and should not be considered a pre-feasibility or feasibility study, as the economics and technical viability of the Project have not been demonstrated at this time. There is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability, and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves.

A National Instrument 43-101 technical report will be filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com within 45 days of the issuance of this news release.

Ivanhoe to host Investor Day on Thursday, December 3, 2020, to discuss new Platreef studies

On December 3, 2020, Ivanhoe will host a virtual Investor Day to discuss the findings of the FS and PEA for the Platreef Project.

DATE: December 3, 2020

TIME: 10am Eastern / 7am Pacific / 3pm London / 11pm Beijing

REGISTRATION LINK: https://bit.ly/3pVhper

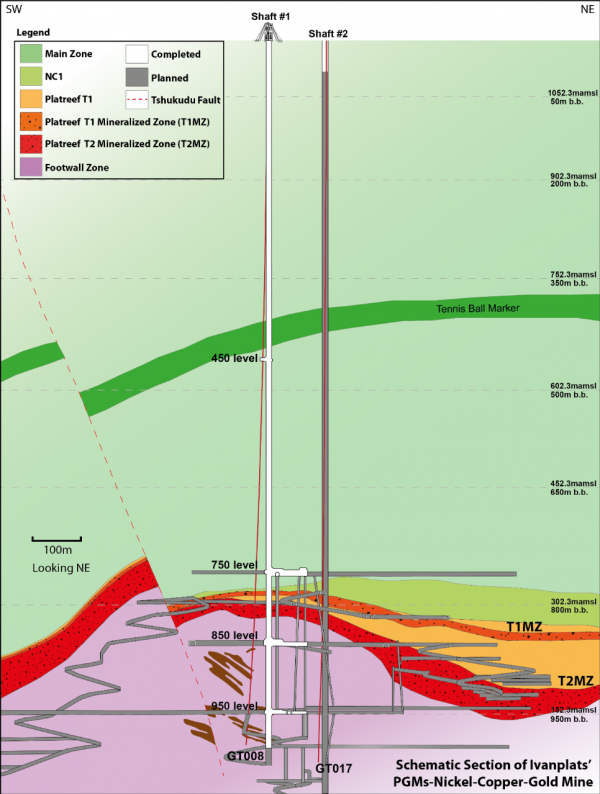

Figure 1: Schematic section of the Platreef Mine, showing Flatreef’s thick, high-grade T1 and T2 mineralized zones (dark orange and red), underground development work completed to date in shafts 1 and 2 (white) and planned development work (grey).

On June 13, 2020, members of the Platreef team celebrated the completion of sinking Shaft 1 to a final depth of 996 metres below surface. Shaft 1’s headframe is in the background.

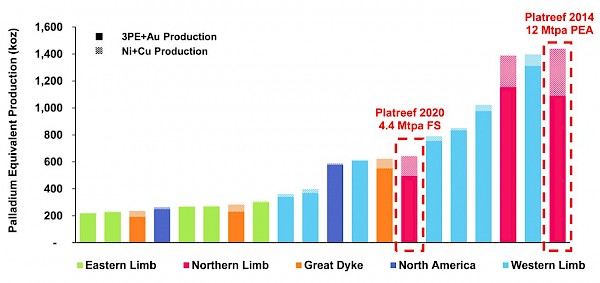

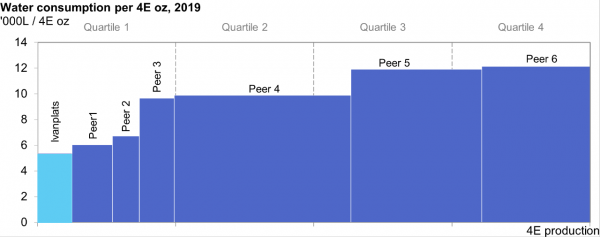

Higher nickel and copper grades contribute to lower cash costs for operations on the Northern Limb of South Africa’s Bushveld Igneous Complex (figures 2, 3 and 4).Among global primary platinum-group-metals producers, Platreef’s estimated net total cash cost of US$442 per 3PE+Au ounce, net of copper and nickel by-product credits and including stay-in-business (SIB) capital costs, ranks at the bottom of the cash-cost curve (Figure 3).

The Platreef IDP20 reflects the first phase of development for the Platreef Mine, producing in excess of 500,000 ounces of 3PE+Au per annum. Previous studies have shown the potential for future expansions up to 12 Mtpa, which would position Platreef among the largest platinum-group metals producing mines in the world, illustrated in Figure 4.

Figure 2: Map of South Africa’s Bushveld Igneous Complex.

Source: SFA (Oxford).

Figure 3: Global primary PGM producers’ net total cash cost + SIB capital (2019), US$/3PE+Au oz.

Source: SFA (Oxford). Data for Platreef Project is based on the Platreef 2020 FS parameters and are not representative of SFA’s view. Net total cash costs have been calculated using base case assumptions of 16:1 ZAR:USD, US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper.

Figure 4: Ranking of global primary PGM producers, based on 2019 palladium equivalent production.

Source: Production estimates for projects other than Ivanhoe’s Platreef Project have been prepared by SFA (Oxford). Production data for the Platreef Project (platinum, palladium, rhodium, gold, nickel and copper) is based on reported FS and PEA data and is not representative of SFA’s view. All metals have been converted to palladium equivalent ounces using base case assumptions of US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper. Note: As the figures are palladium-equivalent ounces of production they will not be equal to 3PE+Au production.

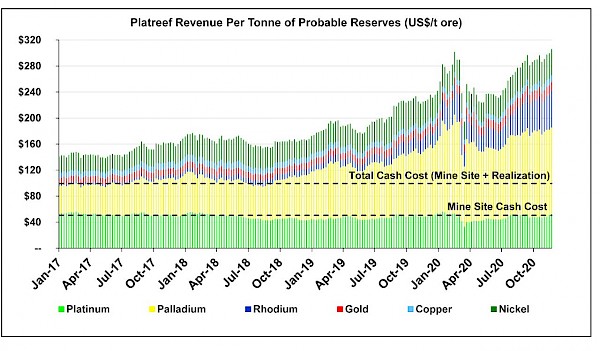

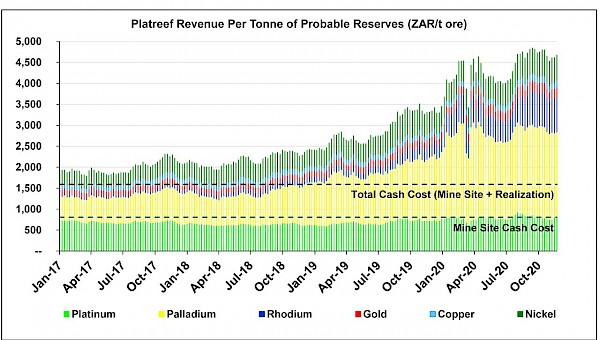

Figure 5: Revenue per tonne of ore at the Platreef Project since 2017 (shown in US dollars).

Figure 6: Revenue per tonne of ore at the Platreef Project has risen significantly since 2017 (shown in South African rand).

Source for figures 5 and 6: Bloomberg. Based on historical weekly commodity prices at the end of each week.

Notes for figures 5 and 6:

- Based on Platreef Mineral Reserves with an effective date of November 30, 2020.

- Probable Mineral Reserve of 124.7 million tonnes at a grade of 1.95 grams per tonne (g/t) platinum, 2.01 g/t palladium, 0.30 g/t gold, 0.14 g/t rhodium, 0.34% nickel and 0.17% copper.

- A declining Net Smelter Return (NSR) cut-off of $155 per tonne (t) to $80/t was used for the Mineral Reserve estimates.

- The NSR cut-off is an elevated cut-off above the marginal economic cut-off.

- Metal prices used in the Mineral Reserve estimate: US$1,600 per ounce (oz.) platinum, US$815/oz. palladium, US$1,300/oz. gold, US$1,500/oz. rhodium, US$8.90 per pound (lb) nickel and US$3.00/lb copper.

- Tonnage and grade estimates include dilution and mining recovery allowances.

- Applies life-of-mine average recoveries of 87.4% for platinum, 86.9% for palladium, 78.6% for gold, 80.5% for rhodium, 87.9% for copper and 71.9% for nickel.

- Total cash cost includes mine site costs, plus realization costs such as treatment and refining charges, royalties and transportation.

HIGHLIGHTS

Updated FS increases production rate to 4.4 Mtpa

- The Platreef 2020 FS evaluates the development of a 4.4-Mtpa underground mine with two concentrators built in modules of 2.2 Mtpa, which updates the 2017 FS by taking into account development schedule advancement, as well as updated costs, metal prices and foreign exchange assumptions.

- The FS has increased throughput from 4.0 Mtpa to 4.4 Mtpa to utilize the full processing capacity of the two concentrators, which is within the mining and hoisting capability of Shaft 2.

- Tailings storage methodology has been modified to a dry-stack tailings facility – a sustainable and water-efficient method wherein tailings are placed and compacted in a mound that is concurrently rehabilitated with soil and vegetation during the operating life of the facility.

- The FS has an average annual production rate of 508,000 ounces (oz.) of platinum, palladium, rhodium and gold (3PE+Au), plus 22 million pounds of nickel and 13 million pounds of copper, at a cash cost of US$442 per ounce of 3PE+Au, net of by-products, and including sustaining capital costs.

- Project schedule is driven by the sinking of Shaft 2, a 10-metre diameter shaft with total rock hoisting capacity of up to 6 Mtpa, plus a 40-tonne capacity double deck man/material cage capable of transporting fully assembled load-haul-dump vehicles and other equipment to support the mine, with first production targeted in 2025.

- Initial capital cost of US$1.4 billion for this option would result in an after-tax net present value at an 8% discount rate (NPV8%) of US$1.8 billion and an internal rate of return (IRR) of 19.8%.

- At spot prices as at November 27, 2020, the NPV8% increases to US$3.7 billion and the IRR increases to 28.4%.

Figure 7: Development and production timeline schematic of Platreef 2020 FS.

Key initial projections from the Platreef 2020 FS

Table 1: Platreef 2020 FS results summary.

|

Item |

Units |

Total / Average Life of Mine |

|---|---|---|

| Mined and processed |

|

|

| Mineral Reserves |

Million tonnes |

125 |

| Platinum |

g/t |

1.95 |

| Palladium |

g/t |

2.01 |

| Gold |

g/t |

0.30 |

| Rhodium |

g/t |

0.14 |

| 3PE+Au |

g/t |

4.40 |

| Copper |

% |

0.17 |

| Nickel |

% |

0.34 |

| Key financial results |

|

|

| Life of mine |

Years |

30 |

| Pre-production capital |

US$ million |

1,438 |

| Mine-site cash cost |

US$ per ounce 3PE+Au |

413 |

| Total cash cost after credits |

US$ per ounce 3PE+Au |

411 |

| All-in cash cost after credits |

US$ per ounce 3PE+Au |

442 |

| Site operating costs |

US$ per tonne milled |

50 |

| After-tax NPV8% |

US$ million |

1,849 |

| After-tax IRR |

% |

19.8 |

| Project payback period |

years |

4.4 |

- The economic analysis is based on Probable Mineral Reserves only.

- 3PE+Au = platinum, palladium, rhodium and gold.

- Metal prices used in the Mineral Reserve estimate are as follows: US$1,600/oz. platinum, US$815/oz. palladium, US$1,300/oz. gold, US$1,500/oz. rhodium, US$8.90/lb nickel and US$3.00/lb copper.

- A declining NSR cut-off of US$155/tonne to $80/tonne was used in the Mineral Reserve estimate.

- Metal price assumptions are as follows: US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper.

- All-in cash costs include sustaining capital costs.

Table 2: Platreef 2020 FS financial results.

|

Discount Rate |

Before Taxation |

After Taxation |

|

|---|---|---|---|

| Net present value (NPV) |

Undiscounted |

12,342 |

9,004 |

| (US$ million) |

5.0% |

4,585 |

3,294 |

|

8.0% |

2,634 |

1,849 |

|

|

10.0% |

1,825 |

1,247 |

|

|

12.0% |

1,253 |

819 |

|

| Internal rate of return (IRR) |

|

22.3% |

19.8% |

| Project payback period |

(Years) |

4.4 |

4.4 |

| Exchange rate |

(ZAR:USD) |

16:1 |

|

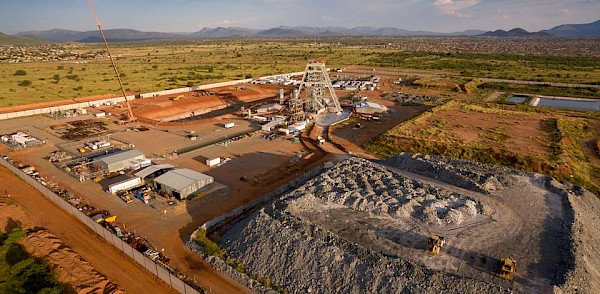

The Platreef Project, with the Shaft 1 headframe and early works construction at the nearby Shaft 2.

Table 3: Platreef 2020 FS average production and processing statistics.

| Item |

Units |

Average Life of Mine |

|---|---|---|

| Average production(1) |

Million tonnes pa |

4.4 |

| Platinum |

g/t |

1.95 |

| Palladium |

g/t |

2.01 |

| Gold |

g/t |

0.30 |

| Rhodium |

g/t |

0.14 |

| 3PE+Au(2) |

g/t |

4.40 |

| Copper |

% |

0.17 |

| Nickel |

% |

0.34 |

| Recoveries |

|

|

| Platinum |

% |

87.4 |

| Palladium |

% |

86.9 |

| Gold |

% |

78.6 |

| Rhodium |

% |

80.5 |

| 3PE+Au(2) |

% |

86.4 |

| Copper |

% |

87.9 |

| Nickel |

% |

71.9 |

| Concentrate produced |

kt/a (dry) |

186 |

| Platinum |

g/t |

38.2 |

| Palladium |

g/t |

39.1 |

| Gold |

g/t |

5.3 |

| Rhodium |

g/t |

2.4 |

| 3PE + Au(2) |

g/t |

85.1 |

| Copper |

% |

3.3 |

| Nickel |

% |

5.5 |

| Recovered metal | ||

| Platinum |

koz/a |

228 |

| Palladium |

koz/a |

233 |

| Gold |

koz/a |

32 |

| Rhodium |

koz/a |

15 |

| 3PE + Au(2) |

koz/a |

508 |

| Copper |

Mlb/a |

13 |

| Nickel |

Mlb/a |

22 |

- Production over the 30-year life of mine for 4.4 Mtpa steady-state production.

- 3PE+Au is the sum of the grades for and production of platinum, palladium, rhodium and gold.

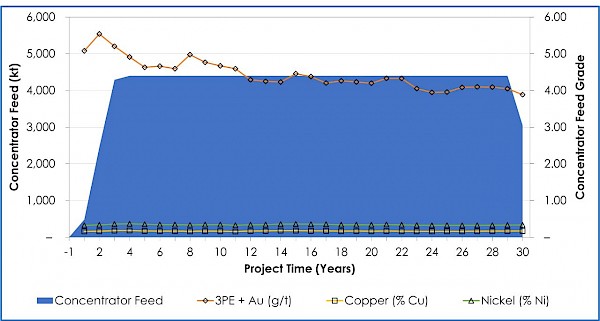

Figure 8: Platreef 2020 FS concentrator production (tonnes milled and grades for the life-of-mine).

Figure by OreWin 2020.

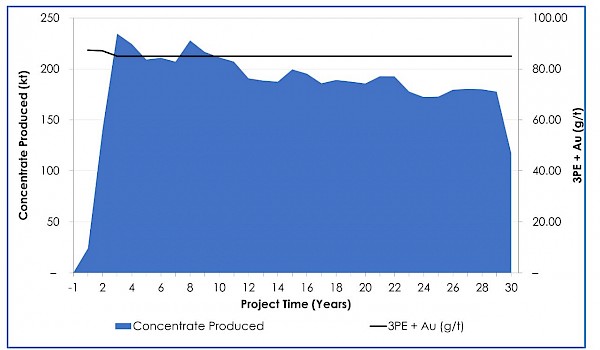

Figure 9: Platreef 2020 FS estimated concentrate produced and 3PE+Au grade for the life-of-mine.

Figure by OreWin 2020.

Table 4: Platreef 2020 FS unit operating costs and cash costs after credits.

|

US$ per ounce of 3PE+Au |

|||

|---|---|---|---|

|

YEARS 1-5 |

YEARS 1-10 |

LIFE-OF-MINE AVERAGE |

|

| Mine site |

470 |

407 |

413 |

| Realization |

316 |

365 |

400 |

| Total cash costs before credits |

786 |

772 |

814 |

| Nickel credits |

292 |

294 |

321 |

| Copper credits |

74 |

73 |

82 |

| Total cash costs after credits |

420 |

404 |

411 |

| Sustaining capital costs |

31 |

30 |

31 |

| All-in cash costs after credits(2) |

452 |

435 |

442 |

- Totals may vary due to rounding.

- All-in cash costs include sustaining capital costs.

Table 5: Platreef 2020 FS capital investment summary

| Description |

Initial Capital |

Sustaining Capital |

Total |

|---|---|---|---|

|

US$M |

US$M |

US$M |

|

| MINING |

|

|

|

| Exploration and geology |

11 |

10 |

21 |

| Mining |

702 |

463 |

1,165 |

| Capitalized operating costs |

48 |

– |

48 |

| Subtotal |

761 |

473 |

1,234 |

| CONCENTRATOR & TAILINGS | |||

| Process Plant |

233 |

14 |

247 |

| Subtotal |

233 |

14 |

247 |

| INFRASTRUCTURE |

|

|

|

| Infrastructure |

254 |

79 |

334 |

| Site Costs |

4 |

4 |

7 |

| Capitalized operating costs |

32 |

– |

32 |

| Subtotal |

290 |

83 |

372 |

| INDIRECTS | |||

| Owners Cost |

30 |

11 |

41 |

| Closure |

1 |

15 |

16 |

| Subtotal |

30 |

26 |

57 |

| CAPITAL EXPENDITURE BEFORE CONTINGENCY |

1,314 |

596 |

1,910 |

| Contingency |

123 |

12 |

135 |

| CAPITAL EXPENDITURE AFTER CONTINGENCY |

1,438 |

607 |

2,045 |

Table 6: Platreef 2020 FS financial results at base case and spot metal prices.

|

Discount Rate |

Base Case Prices(1) |

Spot Prices(2) |

|

|---|---|---|---|

| Net present value (NPV) |

Undiscounted |

9,004 |

15,691 |

| (US$ million) |

5.0% |

3,294 |

6,172 |

|

8.0% |

1,849 |

3,742 |

|

|

10.0% |

1,247 |

2,722 |

|

|

12.0% |

819 |

1,993 |

|

| Internal rate of return (IRR) |

|

19.8% |

28.4% |

| Project payback period |

(Years) |

4.4 |

3.2 |

| Exchange rate |

(ZAR:USD) |

16:1 |

|

- Base case metal price assumptions are as follows: US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper.

- Spot metal prices (November 27, 2020) are as follows: US$968/oz. platinum, US$2,428/oz. palladium, US$1,788/oz. gold, US$16,100/oz. rhodium, US$7.36/lb nickel and US$3.35/lb copper.

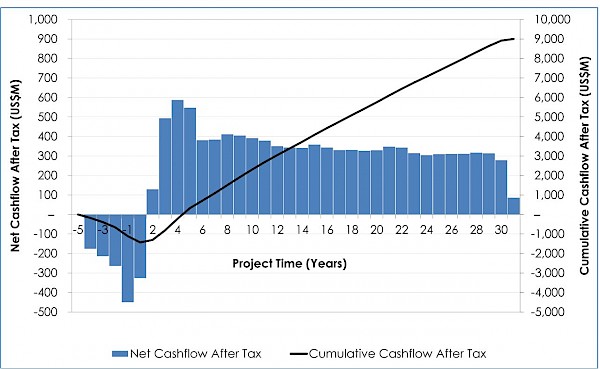

Figure 10: Platreef 2020 FS projected real annual and cumulative cash flow at base case assumptions.

Figure by OreWin 2020.

Phased development plan targets fast-tracking Platreef to production using the recently-completed Shaft 1 development, with significantly lower initial capital costs

- The Platreef 2020 PEA evaluates the phased development of Platreef, with an initial 700-ktpa underground mine and a 770-ktpa capacity concentrator, targeting high-grade mining areas close the Shaft 1, with a significantly lower initial capital cost of US$390 million.

- First concentrate production for this option is targeted in 2024, with the sinking of Shaft 2 recommencing in 2025, to coincide with the construction of two 2.2-Mtpa concentrators to be completed by 2029 and 2030. This would increase the steady production to 5.2 Mtpa by using Shaft 2 as the primary production shaft.

- While the PEA considers the deferral of Shaft 2 sinking to 2025, this is a discrete decision and can be started at any point in time, pending funding.

- By utilizing the 825-ktpa rock-hoisting capacity (including up to 125 ktpa allocated for development rock) of Shaft 1, reduced initial development is required, targeting the nearest and highest-grade stopes with drift-and-fill mining.

- Cost estimates for the phased development plan are largely based on the Platreef 2020 FS, augmented with early drift-and-fill mining and a 770-ktpa concentrator and associated site infrastructure.

- For this option, the PEA envisages phase one during years 1 to 6 at an average annual production rate of 109,000 ounces (oz.) of platinum, palladium, rhodium and gold (3PE+Au), plus 5 million pounds of nickel and 3 million pounds of copper followed by phase two during years 7 to 30 at an average annual production rate of 613,000 oz. of 3PE+Au, plus 27 million pounds of nickel and 16 million pounds of copper.

- The PEA envisages a life-of-mine cash cost of US$460 per ounce of 3PE+Au, net of by-products, and including sustaining capital costs.

- After-tax net present value at an 8% discount rate (NPV8%) of US$1.6 billion and an internal rate of return (IRR) of 20.0%. At spot prices as at November 27, 2020, the NPV8% increases to US$3.3 billion and the IRR increases to 29.1%.

- Construction of the 950-metre-level station near the bottom of the project’s Shaft 1 was recently completed. This station lies within a few hundred metres of the initial high-grade mining zone that would be targeted during the early years of the phased development plan under the alternative development scenario of the 2020 PEA.

- In parallel with the changeover of Shaft 1 for permanent hoisting, detailed engineering will take place in 2021 on the mine design, 770-ktpa concentrator and associated infrastructure design, which will also include the dry stack tailings storage facility. In addition, amendments to the water use licence, waste licence and environmental impact assessment required for the phased development plan will be tabled.

- Following the completion of the changeover, off-shaft development would take place in early 2022 with the initial aim of establishing a ventilation raise, allowing for the development of underground infrastructure from 2023.

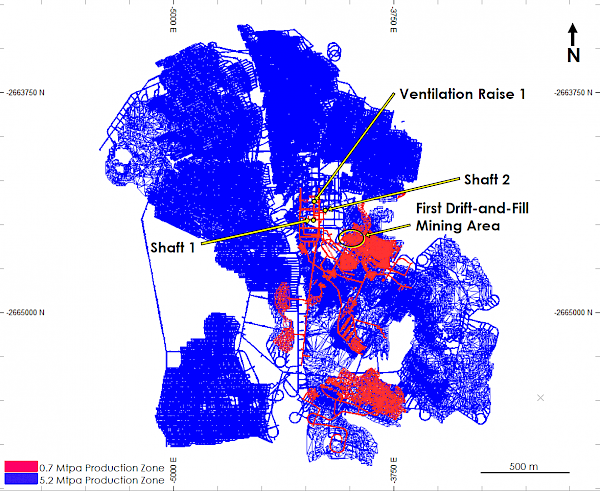

Figure 11: Plan of the Platreef 2020 FS mine design, highlighting areas that are mined in the Platreef 2020 PEA at 700 ktpa and at 5.2 Mtpa.

Figure by OreWin 2020.

Figure 12: Production and timeline schematic of Platreef 2020 PEA.

Key initial projections from the Platreef 2020 PEA

Table 7: Summary of key results of the Platreef 2020 PEA for the phased development plan.

|

Item |

Units |

Total / Average Life of Mine |

|---|---|---|

| Mined and processed |

|

|

| Material Milled |

Million tonnes |

125 |

| Platinum |

g/t |

1.97 |

| Palladium |

g/t |

2.02 |

| Gold |

g/t |

0.30 |

| Rhodium |

g/t |

0.14 |

| 3PE+Au |

g/t |

4.43 |

| Copper |

% |

0.17 |

| Nickel |

% |

0.34 |

| Key financial results |

|

|

| Life of mine |

Years |

30 |

| Initial capital |

US$ million |

390 |

| Expansion capital |

US$ million |

1,269 |

| Peak funding |

US$ million |

1,138 |

| Mine-site cash cost |

US$ per ounce 3PE+Au |

431 |

| Total cash cost after credits |

US$ per ounce 3PE+Au |

428 |

| All-in cash cost after credits |

US$ per ounce 3PE+Au |

460 |

| Site operating costs |

US$ per tonne milled |

53 |

| After-tax NPV8% |

US$ million |

1,615 |

| After-tax IRR |

% |

20.0 |

| Project payback period |

years |

8.4 |

- 3PE+Au = platinum, palladium, rhodium and gold.

- Metal price assumptions for economic analysis are as follows: US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper.

- All-in cash costs include sustaining capital costs.

Albie Brits, Senior Geologist and Manager Project Geology, inspects a piece of high-grade ore obtained from Shaft 1’s intersection of the Flatreef Deposit.

Sample of the high grade palladium-platinum-rhodium-nickel-copper-gold ore.

Table 8: Platreef 2020 PEA financial results.

|

Discount Rate |

Before Taxation |

After Taxation |

|

|---|---|---|---|

| Net present value (NPV) |

Undiscounted |

12,103 |

8,832 |

| (US$ million) |

5.0% |

4,203 |

3,020 |

|

8.0% |

2,298 |

1,615 |

|

|

10.0% |

1,538 |

1,054 |

|

|

12.0% |

1,020 |

672 |

|

| Internal rate of return (IRR) |

|

22.4% |

20.0% |

| Project payback period |

(Years) |

8.3 |

8.4 |

| Exchange rate |

(ZAR:USD) |

16:1 |

|

Students from the University of Johannesburg at the collar of Shaft 2 following a mine tour of the Platreef Project earlier this year.

Table 9: Platreef 2020 PEA average mine production and processing statistics.

| Item |

Units |

Years 1-6 Average |

Years 7-30 Average |

Life of Mine Average |

|---|---|---|---|---|

| Production(1) |

Mtpa |

0.7 |

5.2 |

4.2 |

| Platinum |

g/t |

2.49 |

1.95 |

1.97 |

| Palladium |

g/t |

2.48 |

2.01 |

2.02 |

| Gold |

g/t |

0.40 |

0.30 |

0.30 |

| Rhodium |

g/t |

0.16 |

0.14 |

0.14 |

| 3PE+Au(2) |

g/t |

5.53 |

4.40 |

4.43 |

| Copper |

% |

0.20 |

0.17 |

0.17 |

| Nickel |

% |

0.40 |

0.34 |

0.34 |

| Recoveries |

|

|

|

|

| Platinum |

% |

90.2 |

87.3 |

87.5 |

| Palladium |

% |

90.0 |

86.9 |

87.0 |

| Gold |

% |

80.3 |

78.6 |

78.7 |

| Rhodium |

% |

84.1 |

80.4 |

80.6 |

| 3PE+Au(2) |

% |

89.2 |

86.3 |

86.4 |

| Copper |

% |

90.9 |

87.9 |

88.0 |

| Nickel |

% |

77.8 |

71.9 |

72.1 |

| Concentrate produced |

kt/a (dry) |

40 |

224 |

187 |

| Platinum |

g/t |

39.1 |

38.2 |

38.2 |

| Palladium |

g/t |

38.7 |

39.1 |

39.0 |

| Gold |

g/t |

5.5 |

5.3 |

5.3 |

| Rhodium |

g/t |

2.4 |

2.4 |

2.4 |

| 3PE + Au(2) |

g/t |

85.7 |

85.0 |

85.0 |

| Copper |

% |

3.1 |

3.3 |

3.3 |

| Nickel |

% |

5.5 |

5.5 |

5.5 |

| Recovered metal |

|

|

|

|

| Platinum |

koz/a |

50 |

275 |

230 |

| Palladium |

koz/a |

49 |

282 |

235 |

| Gold |

koz/a |

7 |

38 |

32 |

| Rhodium |

koz/a |

3 |

18 |

15 |

| 3PE + Au(2) |

koz/a |

109 |

613 |

512 |

| Copper |

Mlb/a |

3 |

16 |

13 |

| Nickel |

Mlb/a |

5 |

27 |

23 |

- Production over 6 years at 0.7 Mtpa and 24 years at 5.2 Mtpa.

- 3PE+Au is the sum of the grades for and production of platinum, palladium, rhodium and gold.

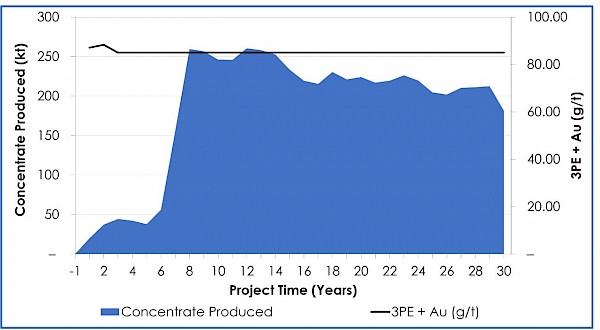

Figure 13: Platreef 2020 PEA concentrator production (tonnes milled and grades for the life-of-mine).

Figure by OreWin 2020.

Figure 14: Platreef 2020 PEA estimated concentrate produced and 3PE+Au grade for the life-of-mine.

Figure by OreWin 2020.

Table 10: Platreef 2020 PEA unit operating costs and cash costs after credits.

|

US$ per ounce of 3PE+Au |

|||

|---|---|---|---|

|

YEARS 1-6 AVERAGE |

YEARS 7-30 AVERAGE |

LOM AVERAGE |

|

| Mine site |

696 |

419 |

431 |

| Realization |

316 |

404 |

400 |

| Total cash costs before credits |

1,012 |

824 |

832 |

| Nickel credits |

318 |

322 |

322 |

| Copper credits |

78 |

82 |

82 |

| Total cash costs after credits |

616 |

420 |

428 |

| Sustaining capital costs |

7 |

14 |

31 |

| All-in cash costs after credits(2) |

623 |

434 |

460 |

- Totals may vary due to rounding.

- All-in cash costs include sustaining capital costs.

Table 11: Platreef 2020 PEA capital investment summary.

| Description |

Initial Capital |

Expansion Capital |

Sustaining Capital |

Total |

|---|---|---|---|---|

|

US$M |

US$M |

US$M |

US$M |

|

| MINING |

|

|

|

|

| Exploration and geology |

0 |

14 |

7 |

21 |

| Mining |

136 |

659 |

382 |

1,177 |

| Subtotal |

137 |

672 |

389 |

1,198 |

| CONCENTRATOR & TAILINGS |

|

|

|

|

| Process Plant |

50 |

245 |

2 |

297 |

| Subtotal |

50 |

245 |

2 |

297 |

| INFRASTRUCTURE |

|

|

|

|

| Infrastructure |

81 |

190 |

75 |

347 |

| Site Costs |

5 |

6 |

1 |

12 |

| Subtotal |

86 |

197 |

76 |

359 |

| INDIRECTS |

|

|

|

|

| Owners Cost |

49 |

39 |

2 |

90 |

| Closure |

– |

1 |

15 |

16 |

| Subtotal |

49 |

39 |

17 |

106 |

| CAPITAL EXPENDITURE BEFORE CONTINGENCY |

322 |

1,153 |

484 |

1,959 |

| Contingency |

68 |

115 |

– |

183 |

| CAPITAL EXPENDITURE AFTER CONTINGENCY |

390 |

1,269 |

484 |

2,142 |

Note: Initial capital reflects the capital costs from January 1, 2021, to achieve initial production of 0.7 Mtpa, followed by expansion capital to reflect the capital costs to achieve full production of 5.2 Mtpa.

Table 12: Platreef 2020 PEA financial results at base case and spot prices.

|

Discount Rate |

Base Case Prices(1) |

Spot Prices(2) |

|

|---|---|---|---|

| Net present value (NPV) |

Undiscounted |

8,832 |

15,580 |

| (US$ million) |

5.0% |

3,020 |

5,714 |

|

8.0% |

1,615 |

3,295 |

|

|

10.0% |

1,054 |

2,316 |

|

|

12.0% |

672 |

1,639 |

|

| Internal rate of return (IRR) |

|

20.0% |

29.1% |

| Project payback period |

(Years) |

8.4 |

7.3 |

| Exchange rate |

(ZAR:USD) |

16:1 |

|

- Base case metal price assumptions are as follows: US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper.

- Spot metal prices (November 27, 2020) are as follows: US$968/oz. platinum, US$2,428/oz. palladium, US$1,788/oz. gold, US$16,100/oz. rhodium, US$7.36/lb nickel and US$3.35/lb copper.

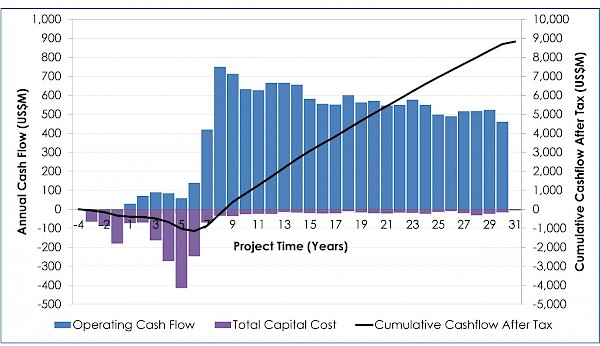

Figure 15: Platreef Mine 2020 PEA projected operating cash flow, total capital costs and cumulative net cash flow after tax, at base case assumptions.

Figure by OreWin 2020.

Platreef Mineral Resources

The mineral resources used as the basis of the PEA and FS were those amenable to underground selective mining. Information on Platreef Project geology and mineralization is contained in the Platreef Project National Instrument (NI) 43-101 Technical Report dated September 4, 2017, filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com .

Table 13: Mineral Resources amenable to underground selective mining methods (base case is highlighted).

|

Indicated Mineral Resources Tonnage and Grades |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Cut-off 3PE+Au |

Mt |

Pt |

Pd |

Au |

Rh |

3PE+Au |

Cu |

Ni |

|

3 g/t |

204 |

2.11 |

2.11 |

0.34 |

0.14 |

4.70 |

0.18 |

0.35 |

|

2 g/t |

346 |

1.68 |

1.70 |

0.28 |

0.11 |

3.77 |

0.16 |

0.32 |

|

1 g/t |

716 |

1.11 |

1.16 |

0.19 |

0.08 |

2.55 |

0.13 |

0.26 |

|

Indicated Mineral Resources |

||||||||

| Cut-off 3PE+Au |

Pt |

Pd |

Au |

Rh |

3PE+Au |

Cu |

Ni |

|

| 3 g/t |

13.9 |

13.9 |

2.2 |

0.9 |

30.9 |

800 |

1,597 |

|

| 2 g/t |

18.7 |

18.9 |

3.1 |

1.2 |

41.9 |

1,226 |

2,438 |

|

| 1 g/t |

25.6 |

26.8 |

4.5 |

1.8 |

58.8 |

2,076 |

4,108 |

|

|

Inferred Mineral Resources Tonnage and Grades |

||||||||

|

Cut-off |

Mt |

Pt |

Pd |

Au |

Rh |

3PE+Au |

Cu |

Ni |

|

3 g/t |

225 |

1.91 |

1.93 |

0.32 |

0.13 |

4.29 |

0.17 |

0.35 |

|

2 g/t |

506 |

1.42 |

1.46 |

0.26 |

0.10 |

3.24 |

0.16 |

0.31 |

|

1 g/t |

1431 |

0.88 |

0.94 |

0.17 |

0.07 |

2.05 |

0.13 |

0.25 |

|

Inferred Mineral Resources Contained Metal |

||||||||

| Cut-off 3PE+Au |

Pt |

Pd |

Au |

Rh |

3PE+Au |

Cu |

Ni |

|

| 3 g/t |

13.8 |

14.0 |

2.3 |

1.0 |

31.0 |

865 |

1,736 |

|

| 2 g/t |

23.2 |

23.8 |

4.3 |

1.6 |

52.8 |

1,775 |

3,440 |

|

| 1 g/t |

40.4 |

43.0 |

7.8 |

3.1 |

94.3 |

4,129 |

7,759 |

|

- Mineral Resources were estimated and finalized April 22, 2016. On 20 November 2020, updated criteria for assessing reasonable prospects of eventual extraction were reviewed to ensure the estimate remained current. The updated effective date is 20 November 2020. The Qualified Person for the estimate is Mr. Timothy Kuhl, RM SME.

- Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The 2 g/t 3PE+Au cut-off is considered the base-case estimate and is highlighted. The rows are not additive.

- Mineral Resources are reported on a 100% basis. Mineral Resources are stated from approximately -200 m to 650 m elevation (from 500 m to 1,350 m depth). Indicated Mineral Resources are drilled on approximately 100 x 100 m spacing; Inferred Mineral Resources are drilled on 400 x 400 m (locally to 400 x 200 m and 200 x 200 m) spacing.

- Reasonable prospects for eventual economic extraction were determined using the following assumptions. Assumed commodity prices are platinum: US$1,600/oz.; palladium: US$815/oz.; gold: US$1,300/oz.; rhodium: US$1,500/oz.; copper: US$3.00/lb; and nickel: US$8.90/lb. It has been assumed that payable metals would be 82% from smelter/refinery and that mining costs (average US$34.27/t) and process, general and administrative costs, and concentrate transport costs (average US$15.83/t of mill feed for a four Mtpa operation) would be covered. The processing recoveries vary with block grade but typically would be 80%-90% for platinum, palladium and rhodium; 70-90% for gold; 60-90% for copper; and 65-75% for nickel.

- 3PE+Au = platinum, palladium, rhodium and gold.

- Totals may not sum due to rounding.

Platreef 2020 FS Mineral Reserve

The mineral resources used as the basis of the PEA and FS were those amenable to underground selective mining. Information on Platreef Project geology and mineralization is contained in the Platreef Project National Instrument (NI) 43-101 Technical Report dated September 4, 2017, filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com .

Table 14: Probable Mineral Reserves – tonnage and grades as at November 30, 2020.

|

Method |

Mt | NSR ($/t) |

Pt (g/t) |

Pd (g/t) |

Au (g/t) |

Rh (g/t) |

3PE+Au (g/t) |

Cu (%) |

Ni (%) |

|---|---|---|---|---|---|---|---|---|---|

| Ore development |

11.1 |

159.9 |

1.96 |

2.05 |

0.30 |

0.14 |

4.45 |

0.17 |

0.35 |

| Long-hole |

93.1 |

152.1 |

1.88 |

1.95 |

0.29 |

0.13 |

4.25 |

0.16 |

0.33 |

| Drift-and-fill |

20.4 |

182.0 |

2.28 |

2.23 |

0.37 |

0.15 |

5.03 |

0.18 |

0.37 |

| Total |

124.7 |

157.7 |

1.95 |

2.01 |

0.30 |

0.14 |

4.40 |

0.17 |

0.34 |

| Method |

Mt |

Pt |

Pd |

Au |

Rh |

3PE+Au |

Cu |

Ni |

|---|---|---|---|---|---|---|---|---|

| Ore development |

11.1 |

0.7 |

0.7 |

0.1 |

0.05 |

1.6 |

42 |

85 |

| Long-hole |

93.1 |

5.6 |

5.8 |

0.9 |

0.4 |

12.7 |

333 |

681 |

| Drift-and-fill |

20.4 |

1.5 |

1.5 |

0.2 |

0.1 |

3.3 |

83 |

167 |

| Total |

124.7 |

7.8 |

8.0 |

1.2 |

0.5 |

17.6 |

457 |

932 |

- Mineral Reserves have an effective date of November 30, 2020. The Qualified Person for the estimate is Jon Treen (Stantec), P. Eng., with Professional Engineers of Ontario.

- A declining NSR cut-off of US$155/t to US$80/t was used for the Mineral Reserve estimates.

- The NSR cut-off is an elevated cut-off above the marginal economic cut-off.

- Metal prices used in the Mineral Reserve estimate are as follows: US$1,600/oz. platinum, US$815/oz. palladium, US$1,300/oz. gold, US$1,500/oz. rhodium, US$8.90/lb nickel and US$3.00/lb copper.

- Metal-price assumptions used for the FS economic analysis are as follows: US$1,050/oz. platinum, US$1,400/oz. palladium, US$1,560/oz. gold, US$5,000/oz. rhodium, US$7.30/lb nickel and US$3.10/lb copper.

- Tonnage and grade estimates include dilution and mining recovery allowances.

- Total may not add due to rounding.

- 3PE+Au = platinum, palladium, rhodium and gold.

Platreef to be mined primarily using highly-productive mechanized methods

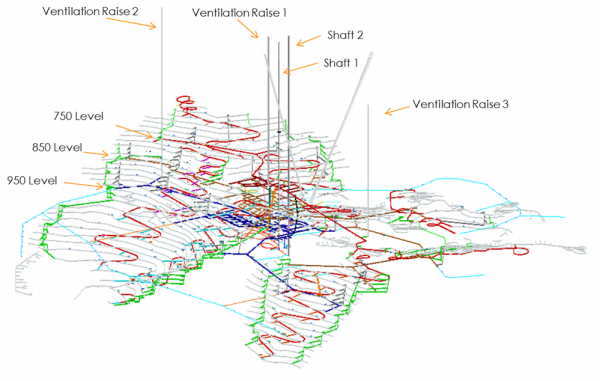

Mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. Once expanded mine production is achieved, primary access to the mine will be by way of a 1,104-metre-deep, 10-metre-diameter production shaft (Shaft 2). Secondary access to the mine will be via the 996-metre-deep, 7.25-metre-diameter ventilation shaft (Shaft 1) that recently has been sunk to its final depth. During mine production, both shafts also will serve as ventilation intakes. Three additional ventilation exhaust raises (Ventilation Raise 1, 2, and 3) are planned to achieve steady-state production.

Mining will be performed using highly-productive mechanized methods, including long-hole stoping and drift-and-fill. Each method will utilize cemented backfill for maximum ore extraction. The production plans in both the PEA’s initial five-year drift-and-fill mining operation off of Shaft 1 and the larger FS expansion are focused on maximizing higher-grade areas, which was achieved through optimization based on stope locations, stope grades, mining method, and zone productivities. The orebody was targeted to recover approximately 125 million tonnes at the highest net smelter return.

The ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Figure 16: Platreef underground mine access layout.

Figure by Stantec.

Conventional PGM flowsheet at Platreef

Metallurgical testwork has focused on maximizing recovery of platinum-group elements (PGE) and base metals, mainly nickel, while producing an acceptably high-grade concentrate suitable for further processing and/or sale to a third party. The three main geo-metallurgical units and composites tested produced smelter-grade final concentrates averaging 85 g/t PGE+Au, at acceptable PGE recoveries. Testwork also has shown that the material is amenable to treatment by conventional flotation without the need for mainstream or concentrate ultrafine re-grinding. Extensive bench-scale testwork comprising of open-circuit and locked-cycled flotation testing, comminution testing, mineralogical characterization, tailings dewatering and rheological characterization was performed at Mintek in South Africa, which is an internationally accredited metallurgical testing facility and laboratory.

Comminution and flotation testwork has indicated that the optimum grind for beneficiation is 80% passing 75 micrometres. Platreef ore is classified as being ‘hard’ to ‘very hard’ and thus not suitable for semi-autogenous grinding; a multi-stage crushing and ball-milling circuit has been selected as the preferred size reduction route.

Improved flotation performance has been achieved using high-chrome grinding media as opposed to carbon steel media. The inclusion of a split-cleaner flotation circuit configuration, in which the fast-floating fraction is treated in a cleaner circuit separate from the medium- and slow-floating fractions, resulted in improved PGE, copper and nickel recoveries and concentrate grades.

A two-phased development approach was used for the flow-sheet design comprising a common three-stage crushing circuit, feeding crushed material to milling-flotation modules. Flotation is followed by a common concentrate thickening, concentrate filtration, tailings disposal and tailings-handling facility. The phased approach allows for increased processing flexibility and introduces process redundancy whilst allowing for phasing of capital and mine ramp-up.

The Platreef 2017 FS was based on a nominal processing capacity of 4.0 Mtpa, aligned to the mine plan and schedule at the time. The process plant, however, was adequately sized to treat a maximum of 4.4 Mtpa (2 x 2.2 Mtpa modules). This higher processing rate has been utilized in the Platreef 2020 FS.

To further evaluate optimization opportunities and confirm additional detail design parameters, a mini pilot plant testwork program is proposed and will be undertaken as part of the project implementation phase.

Sustainable, dry stacking tailings storage methodology

The proposed tailings storage facility (TSF) will be developed as a dry stack TSF with an estimated operating life of 32 years. During this time, approximately 55.4 million tonnes of tailings will be stored within the dry stack TSF, with the remainder of the tailings to be used as backfill in the underground mine. The dry stack TSF design also caters for an 8-Mtpa ramp-up in production to be explored in future studies. The dry stack TSF is compliant in terms of required tonnage profile production split between the backfill requirement and dry stack TSF of 35% on average, but is conservatively designed for 40% of non-ore material reporting to the TSF.

Since the Platreef 2017 FS, a hybrid paddock deposition methodology was proposed; however, Ivanplats has decided to change the TSF deposition methodology from upstream design to dry stacking in the Platreef 2020 PEA and FS. Followingon a study undertaken by Golder Associates Africa in December 2016, it was concluded that stacked tailings storage facilities are deemed to be safer in that there is no hydraulic deposition, hence the risk will be minimal to flood the surrounding areas with tailings in the unlikely event of a catastrophic failure.Stacked tailing storage facilities are more water efficient in that the majority of water in the tailings is captured in the dewatering plant, pumped directly back to the concentrator and re-used within the process.

The stacked facility will comprise a starter dam constructed primarily of rock fill, engineered tailings, nominally compacted tailings, and random fill. Tailings will be delivered to the dewatering plant situated at the stacking facility utilizing the same pumping systems from the processing plant. Dried tailings will be delivered to the stacking facility using load and haul transportation with trucks from the dewatering plant. Aside from the rock fill in the starter dam and drainage elements, which include a return water dam, the facility will be developed using dewatered tailings. The infrastructure will have to be in place upon start-up.

For the Platreef 2020 PEA development scenario, it is envisaged to utilize the approved rock dump footprint within the immediate Platreef mine and concentrator areas, as a dry stacking tailings facility for the initial 700-ktpa mine. Golder Associates currently is performing the design work in order to apply for the relevant licences and/or amendments to the existing authorizations.

Supply of water and electricity

The Platreef Project’s water requirement for the first phase of development is projected to peak at approximately 7.5 million litres per day. On May 7, 2018, Ivanhoe announced the signing of a new agreement to receive local, treated water to supply most of the bulk water needed for the first phase of production at Platreef. The Mogalakwena Local Municipality has agreed to supply a minimum of five million litres of treated water per day for 32 years from the town of Mokopane’s new Masodi Waste Water Treatment Works. Initial supply will be used in Platreef’s ongoing underground mine development and surface infrastructure construction.

Under the terms of the agreement, which is subject to certain suspensive conditions, Ivanplats will provide financial assistance to the municipality for certified costs of up to a maximum of R248 million (approximately US$16 million) to complete the Masodi treatment plant. Ivanplats will purchase the treated water at a reduced rate of R5 per thousand litres for the first 10 million litres per day to offset a portion of the initial capital contributed.

On February 24, 2017, the five-million-volt-ampere (MVA) electrical power line connecting the Platreef site to the Eskom public electricity utility was energized and now is supplying electricity to Platreef for shaft sinking and construction activities. The new power line – a collaboration between Platreef, Eskom and the Mogalakwena Local Municipality – also established a platform to provide energy to the neighboring community of Mzombane, which previously was without electricity reticulation and supply.

Platreef’s electrical power requirement for the 4.4-Mtpa underground mine, concentrator and associated infrastructure has been estimated at approximately 100 MVA. An agreement has been reached with Eskom for the supply of power. For the Platreef 2020 PEA development scenario, Ivanhoe currently is negotiating the load build up with Eskom to cater for the initial 700-ktpa mine.

Figure 17: Lowest water consumption per 3PE+Au oz. compared to South African PGM producers

Source: SFA (Oxford). Water consumption estimates for projects other than Ivanhoe’s Platreef Project have been prepared by SFA (Oxford).

Update on construction progress and Shaft 1 repair work

The construction of the 996-metre-level station at the bottom of Shaft 1 was completed in July 2020. The completed Shaft 1 is located approximately 350 metres away from a high-grade area of the Flatreef orebody that is planned for bulk-scale, mechanized mining.

Early-works surface construction for Shaft 2 began in 2017. It includes the excavation of a surface box-cut to a depth of approximately 29 metres below surface and construction of the concrete hitch for the 103-metre-tall concrete headgear (headframe) that will house the shaft’s permanent hoisting facilities and support the shaft collar.

As previously reported on September 14, 2020, a tragic accident occurred in Shaft 1 as a result of a kibble bucket falling down the shaft and striking the northern side of the working platform. The legal review process into the accident as outlined by the South African Mine Health and Safety Act is ongoing. The Mine Health and Safety Inspectorate has completed its investigation under Section 60 of the Mine Health and Safety Act, and preliminary findings attributed the primary cause of the tragic accident to a very rare electronic device failure and that all mine safety standards and safe operating procedures were fully complied with.It is anticipated that the formal statutory inquiry will be convened in the new year.

Remedial actions to bring the shaft safely back into operation are underway with the installation of a temporary pumping system and removal of the old stage ropes at shaft bottom. The new stage fabrication is well advanced with delivery expected at the end of December 2020; followed by the stage assembly planned for early January 2021. Delivery of the new kibble rope and stage ropes is expected mid-December, with the plan to install the new ropes by mid-January 2021. In parallel to this, all equipping procurement items are well advanced with the service winder delivery expected mid-January and installation and commissioning of the kibble winder control unit upgrade expected end of the first quarter of 2021. Once this has been completed, the actual equipping will commence with the anticipated completion in the first quarter of 2022. This will enable Shaft 1 to be equipped for hoisting.

Pierre Kruger, Banksman (left), and Sipho Monama, Engineering Graduate (right), members of the Platreef team bringing Shaft 1 safely back into operation.

Development of human resources and job skills

Community consultation on the Platreef Project’s second Social and Labour Plan (SLP) is in the final stages. In this second SLP, Ivanplats plans to build on the foundation laid in the first SLP and continue with its training and development suite, which includes 15 new mentors, internal skills training for 78 staff members, a legends program to prepare retiring employees with new/other skills, community adult education training for host community members, core technical skills training for at least 100 community members, portable skills, and more.

Local economic development projects will contribute to community water source development with the Mogalakwena Municipality boreholes program, educational program in partnership with Department of Education, and significant contribution funding for sanitation infrastructure at the municipality.

The enterprise and supplier development commitments comprise of expanding the existing kiosk and laundry facilities and adding expanded change house facilities to be managed by a community partner in the future. A five year, integrated business accelerator and funding project will assist interested community members to obtain help with development and supplier readiness.

The Platreef Project supports a number of educational programs, including the E-learning project and the maintenance of science and computer laboratories, as well as the provision of free Wi-Fi in host communities. In pursuit of Ivanhoe’s decarbonization agenda, the Platreef Project planted 25 trees at two local schools in the mine’s footprint area.

Mothepana Shirley Matlala, Diesel Mechanic, is a member of Ivanplats’ growing team of bright, young South Africans that are leading the development of the modern underground mine being built at Platreef. Ivanhoe is committed to helping build the next generation of qualified tradespeople by creating access to, and elevating, skilled trades.

Financing discussions underway

Advanced financing discussions are underway with a number of parties, for up to US$400 million in funding from a combination of project finance, mezzanine debt and streaming, for the phased development plan outlined in the Platreef 2020 PEA. This will then underpin the funding for the larger development scenario as outlined in the Platreef 2020 FS.

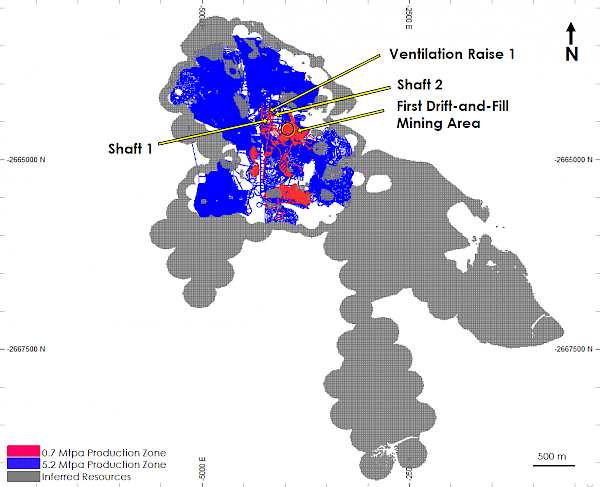

Future expansion options

The Platreef 2020 FS and PEA consider only the first phase of development for Platreef, to establish an operating platform to support future expansions. Figure 18 shows the size and potential of the Platreef resource base where the Platreef 2020 PEA only uses approximately one third of the resource above an US$80/t NSR cut-off, which provides the opportunity to ramp up production to larger production rates as the market dictates. With an attractive first phase of development reflected by the Platreef IDP20, Ivanhoe plans to revisit previous studies dating back to 2014 that have demonstrated the potential for Platreef to support future expansions up to 12 Mtpa, producing in excess of 1.1 million ounces of palladium, platinum, rhodium and gold per year.

Figure 18: Platreef 2020 PEA production zones and inferred mineral resources.

Figure by OreWin 2020.

Qualified persons

The following companies have undertaken work in preparation of the IDP and Technical Report:

- OreWin of Adelaide, Australia – Overall report preparation and economic analysis.

- Wood Group (formerly Amec Foster Wheeler) of Vancouver, Canada – Mineral Resource estimation.

- SRK Consulting of Johannesburg, South Africa – Mine geotechnical recommendations.

- Stantec Consulting of Phoenix, USA – Mineral Reserve estimation and mine plan.

- DRA Global of Johannesburg, South Africa – Process and infrastructure.

- Golder Associates Africa of Midrand, South Africa – Water and tailings management.

The independent qualified persons responsible for preparing the Platreef Integrated Development Plan 2020, on which the technical report will be based, are Bernard Peters (OreWin); Timothy Kuhl (Wood); William Joughin (SRK); Jon Treen (Stantec); Val Coetzee (DRA Global); and Francois Marais (Golder Associates). Each person has reviewed and approved the information in this news release relevant to the portion of the Platreef IDP20 for which they are responsible.

Other scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Sample preparation, analyses and security

During Ivanhoe’s work programs, sample preparation and analyses were performed by accredited independent laboratories. Sample preparation is accomplished by Set Point laboratories in Mokopane. Sample analyses have been accomplished by Set Point Laboratories (Set Point) in Johannesburg, Lakefield Laboratory (Lakefield’ now part of the SGS Group) in Johannesburg, Ultra Trace (Ultra Trace) Laboratory in Perth, Genalysis Laboratories, Perth and Johannesburg (Genalysis), SGS Metallurgical Services (SGS) in South Africa, Acme in Vancouver, and ALS Chemex in Vancouver. Bureau Veritas Minerals Pty Ltd (Bureau Veritas) assumed control of Ultra Trace during June 2007 and is responsible for assay results after that date.

Sample preparation and analytical procedures for samples that support Mineral Resource estimation have followed similar protocols since 2001. The preparation and analytical procedures are in line with industry-standard methods for Pt, Pd, Au, Cu, and Ni deposits. Drill programmes included insertion of blank, duplicate, standard reference material (SRM), and certified reference material (CRM) samples. The quality assurance and quality control (QA/QC) programme results do not indicate any problems with the analytical protocols that would preclude use of the data in Mineral Resource estimation.

Sample security has been demonstrated by the fact that the samples were always attended or locked in the on-site core facility in Mokopane.

Information on sample preparation, analyses and security is contained in the Platreef Project NI 43-101 Technical Report dated September 4, 2017, filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com .

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal joint-venture projects in Southern Africa: the development of major new, mechanized, underground mines at the Kamoa-Kakula discoveries in the Democratic Republic of Congo (DRC) and at the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC. Kamoa-Kakula and Kipushi will be powered by clean, renewable hydroelectricity and will be among the world’s lowest greenhouse gas emittersper unit of metal produced. Ivanhoe also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project.

Information contacts

Investors: Bill Trenaman +1.604.331.9834 / Media: Matthew Keevil +1.604.558.1034

Cautionary statement on forward-looking information

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements of the company, the Platreef Project, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results, and speak only as of the date of this news release.

The forward-looking statements and forward-looking information in this news release include without limitation, (i) statements regarding the Platreef budget for 2021 is US$59 million, which includes US$10 million for commencement of the construction of the headframe to the collar of Shaft 2; (ii) statements regarding the Platreef IDP20 is designed to establish an operating platform to support potential future expansions up to 12 Mtpa producing in excess of 1.1 million ounces of palladium, platinum, rhodium and gold per year, as demonstrated in previous studies, which would position Platreef among the largest platinum-group-metals producing mines in the world; (iii) statements regarding the feasibility study confirms without a shadow of a doubt, that not only is Platreef one of the largest, richest precious metals deposits on the planet, but it also will be one of the lowest-cost operations and feature exceptional returns on capital; (iv) statements regarding in parallel with the changeover of Shaft 1 for permanent hoisting, detailed engineering will take place in 2021 on the mine design, 770-ktpa concentrator and associated infrastructure design and amendments to the water use licence, waste licence and environmental impact assessment required for the phased development plan will be tabled; (v) statements regarding following the completion of the changeover, off-shaft development would take place in early 2022 with the initial aim of establishing a ventilation raise, allowing for the development of underground infrastructure from 2023; (vi) statements regarding local economic development projects at Platreef will contribute to community water source development with the Mogalakwena Municipality boreholes program, educational program in partnership with Department of Education and significant contribution funding for sanitation infrastructure at the municipality; and (vii) statements regarding the installation and commissioning of the Shaft 1 kibble winder control unit upgrade expected by end of the first quarter of 2021, and the anticipated completion of equipping Shaft 1 for hoisting in the first quarter of 2022.

In addition, all of the results of the Platreef IDP20, Platreef 2020 PEA and Platreef 2020 FS constitute forward-looking statements and forward-looking information. The forward-looking statements include metal price assumptions, cash flow forecasts, projected capital and operating costs, metal recoveries, mine life and production rates, and the financial results of the Platreef 2020 PEA and FS. These include estimates of internal rates of return after-tax of 20.0% (PEA) and 19.8% (FS) with payback periods of 8.4 years and 4.4 years respectively; net present values including a PEA NPV at an 8% discount rate of US$1.6 billion and a FS NPV at an 8% discount rate of US$1.8 billion; future production forecasts and projects, including average annual production of 512koz 3PE+Au in the PEA and 508koz 3PE+Au in the FS; estimates of net total cash cost, net of copper and nickel by-product credits and including stay-in-business (SIB) capital costs of US$460/oz. 3PE+Au in the PEA and US$442/oz. 3PE+Au in the FS; mine life estimates, including a 30 year mine life in the PEA and a 30 year mine life in the FS; initial capital costs of US$0.39 billion in the PEA and US$1.4 billion in the FS; average 3PE+Au grades of 4.4 g/t in the PEA and 4.4 g/t in the FS; cash flow forecasts; estimates of 3PE+Au recoveries of 86.4% in the PEA and 86.4% in the FS. Readers are cautioned that actual results may vary from those presented.

All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, industrial accidents or machinery failure (including of shaft sinking equipment), or delays in the development of infrastructure, and the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Readers are cautioned not to place undue reliance on forward-looking information or statements. Certain of the factors and assumptions used to develop the forward-looking information and statements, and certain of the risks that could cause the actual results to differ materially are presented in the “Platreef 2020 Feasibility Study”, available on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources and Mineral Reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on, among other things: (i) fluctuations in platinum, palladium, gold, rhodium, copper, nickel or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) changes to proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

English

English Français

Français 日本語

日本語 中文

中文